Trust. Expertise. Family.

₹300+ Cr AUM. 800+ investors.

Engineering precision in personal finance, since 2000.

Led by Chittaranjan Vhora, an engineer and former industrialist who built and ran a manufacturing plant, VhoraFundz blends shop‑floor discipline with a family‑first ethos in the distribution of financial products. We keep Goals First, Products Second: strengthen financial hygiene (emergency fund, adequate insurance), then design disciplined, goal‑based investments with transparent reviews. Calm, available, steadfast and ethical, we firmly stand with you through market cycles and life stages.

An approach built around you.

We start with your life goals. Whether you’re planning for your child’s education, a home upgrade, retirement, or protecting your family’s future, our process is designed entirely around your needs. We take the time to understand your priorities, assess your financial health, and match you with strategies that align with both your goals and comfort with risk. From your first consultation to regular reviews, every step is transparent, disciplined, and personalised — so your financial plan always fits your life and works for you, not the other way around.

What We Stand For

At VhoraFundz, our work is guided by a clear set of principles: Goals First, Products Second, always starting with your life ambitions before choosing any investments. We believe in complete transparency, explaining the pros and cons of every option in simple terms so you can make informed decisions. Financial hygiene comes first — ensuring you have an emergency fund, adequate insurance, and a handle on debt before wealth creation begins. We value relationships that span decades, often across generations, and we earn trust daily through consistent, ethical, and client-first actions.

Who We Serve

Our clients range from young professionals taking their first serious steps toward wealth creation, to families planning for education, home ownership, and retirement, to NRIs and OCIs seeking tax-efficient investments in India. We also work with business owners, SMEs, trusts, and institutions to manage surplus funds with discipline and compliance. Many self-directed investors come to us for portfolio reviews, looking for expert guidance to align their strategies with their goals and risk profiles. No matter your stage in life, we bring the same clarity, discipline, and personal commitment to every relationship.

Our Process

Our client journey is designed to be structured, personal, and easy to follow. We begin by understanding your goals and timelines, then assess your risk capacity, current portfolio, and financial hygiene essentials. Once the foundation is in place, we create a tailored investment plan aligned with your needs, set it in motion systematically, and monitor its progress. Reviews are regular, rebalancing is disciplined, and communication is proactive — especially during market shifts. As your life evolves, we stay by your side, ensuring your investments remain aligned with your priorities and your peace of mind stays intact.

Meet our team

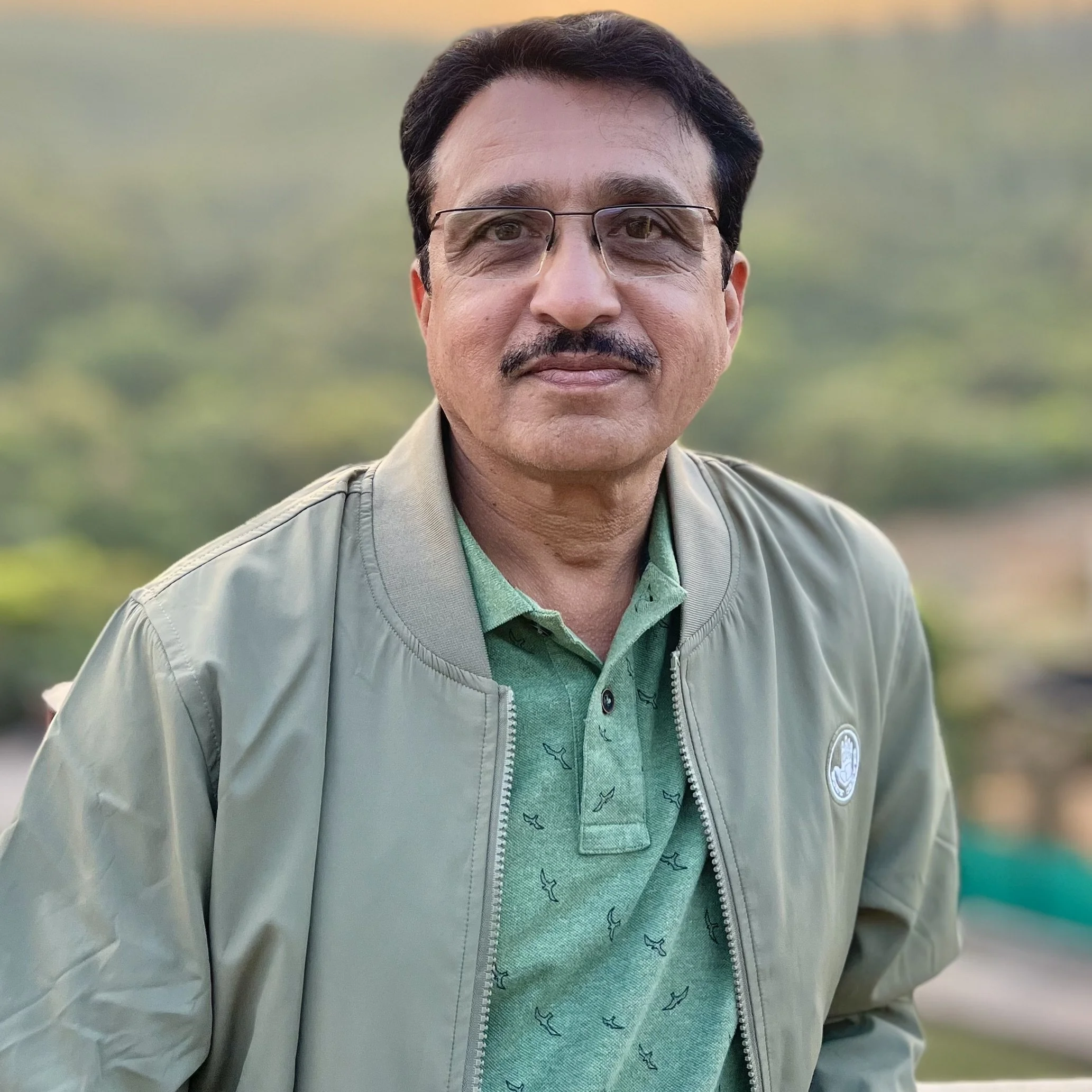

-

Chittaranjan Vhora

Founder, Mentor

-

Vaishali Vhora

Head of Insurance

-

Nikita Vhora

Consultant, Technology

-

Sushrut Munje

Consultant, Technology